Donald Trump takes the stage to address supporters at his rally, at the Palm Beach County Convention Center in West Palm Beach, Florida, November 6.

Image: Brian Snyder / Reuters

As Donald Trump returns as President of the United States for a second time, the red sweep of Republicans is expected to have a spillover effect on the world economy amid a volatile environment and uncertain policies. A red senate and house of representatives mean that Trump will have a clear space to pass regulations in the coming years.

Typically, Trump’s policies are relatively expansionary in nature. However, there are many moving parts, and market reactions in the short-term can be starkly different from those in the medium to long term, say analysts.

For instance, Trump’s ‘Make America Great Again’ may make China sweat on its exports but Indian companies are betting on likely a sentimental effect of benefitting from the ‘China+ 1’ strategy. Not to forget, Trump has already indicated his preferences for lowering tax rates for corporates, especially those manufacturing in the US, to 15 percent from 21 percent. Trump is also likely to impose 60 percent or higher tariffs on imports from China and 10-20 percent on the rest of the world.

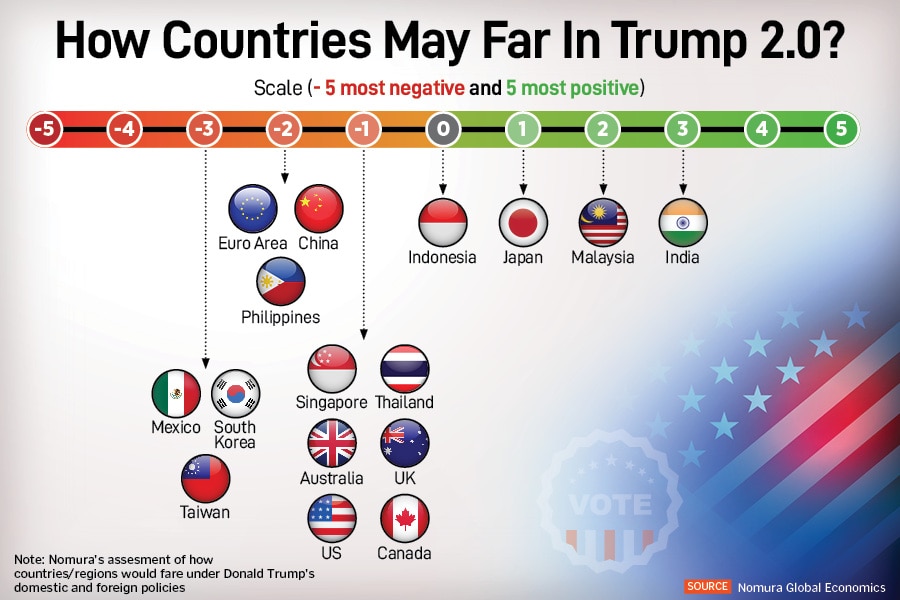

“Trump 2.0 will likely mean more policy uncertainty, which we see as negative for Asia,” say analysts at Nomura. According to them, Trump’s re-election has less of a shock factor, given greater familiarity with his policies. Asia is also more resilient, due to the ongoing trends of US-China decoupling, shifts in global supply chains and lower Asian exports to China.

“While the broader impact—economic and geopolitical—is negative for Asia, especially for China and South Korea, we believe India and Malaysia should be relative beneficiaries,” they add. However, they also feel Asia is better prepared this time, but a larger economic growth drag and disinflation now look more likely in 2025.

Having comfortably surpassed the minimum requirement of 270 seats, Trump and the Republican Party made a decisive victory in the 2024 US presidential election. The Republicans have also secured a majority in the US Senate. “This implies that Trump’s plans for tax cuts, levy of tariffs, healthcare reforms and energy policy, have a higher probability of getting implemented,” says Venkatesh Balasubramaniam, managing director and co-head of research, JM Financial.

Being president of a superpower, Trump’s new term is anticipated to bring in sea changes in equity markets worldwide, currencies, commodities, central banks’ monetary policy decisions and countries specifically dependent on the US for export revenue.

“Perhaps the most important question for investors is what is and isn’t priced into markets. As is to be expected in volatile periods, not all asset classes move in tandem,” says Ajay Rajadhyaksha, Barclays. He adds that for the US equity markets, the biggest focus items from a second Trump presidency are taxes and tariffs.

The most direct impact of Trump’s presidency will be lower corporate taxes for US manufacturing which will also drive capex and jobs. “However, this can also increase the US fiscal deficit and keeps interest rates high,” says Balasubramaniam. Secondly, higher tariffs on China and the rest of the world could be inflationary which could also lead to retaliatory tariffs from trade partners, leading to a slowdown in global growth.

Thirdly, lower involvement of the US in geopolitical conflicts and Trump’s push for oil & gas can bring down crude oil prices. Trump is also anticipated to increase influence over the US Federal Reserve to lower rates and a stronger US dollar.

Also read: Six Indian-Americans Who Won the 2024 US elections

Equities, currency, rates: Policy shift?

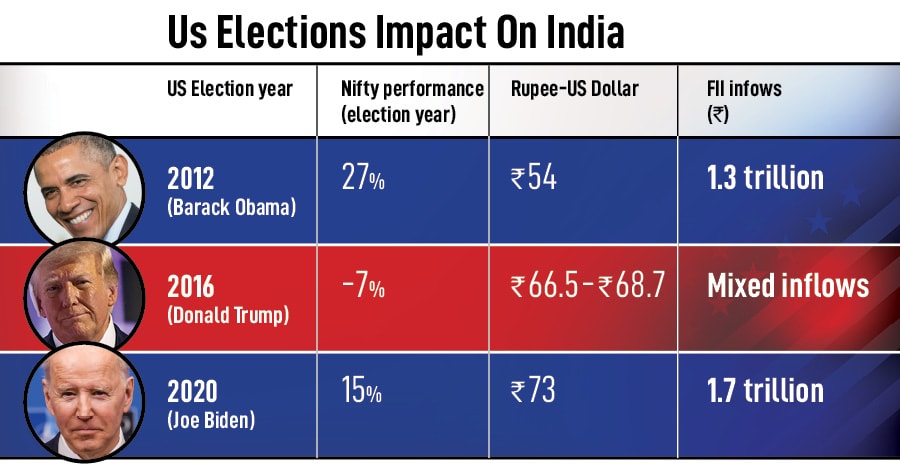

Indian equities are already grappling with deep corrections due to multiple factors such as stimulus measures by China, leading to portfolio flows back into Chinese assets and possibly some rotation out of India.

R Janakiraman, CIO-emerging markets equity-India, Franklin Templeton, however, feels that the impact of the US election outcome is likely to be restricted on India. Though he adds shifts in the US involvement in global conflicts and geopolitical alliances may introduce uncertainties. “Indian markets performance over the past five years has largely been driven by strong earnings growth, supported by domestic factors such as multi-year capital expenditure cycle and shifting consumer trends,” he says.

Indian markets faced an outflow of foreign institutional investors (FIIs) money worth $1.5 billion in November following a sell-off of $11 billion in the previous month. That has already sunken markets as the benchmark index Nifty lost 6 percent in October, one of its worst monthly performances since the lockdown-related sell-off in March 2020.

As Trump’s return to presidency is likely to boost US equities, consequently, foreign money is expected to chase such high return assets over Indian markets which is trading at an expensive valuation while corporate earnings are also lagging. US equities are positioned to outperform, as Trump is considered pro-markets.

“Trump is positive US but negative rest of the world. Global growth is likely to slow,” say analysts at Angel One Wealth. The equity reaction of specific economies will depend on their policy formation to tackle exports to the US and the robustness of domestic demand. However, in events like these, one needs to separate short-term, knee jerk reactions from more long- term perspectives.

According to analysts at Angel One Wealth, Trump is expected to behave exactly like he did in 2016. “We believe changes to his outlook can’t be fully ruled out. Therefore, a lot of narratives may shift when numbers come into play as and when policies are formulated,” they add.

The dollar is one of the assets most affected by the election result. Assuming Trump does target large-scale tariffs against Europe and China, the dollar will appreciate. A strong dollar index is a negative emerging markets trade.

“India getting shielded from that macro headwind is a far possibility. The US doing well is likely to be anti-EM. Secondly, one can’t rule out Trump imposing tariffs on India either because of geopolitical reasons or for running a trade surplus with $36 billion FY24 or for having a perceivably managed currency—all of which have historical context. These factors could make the current equity market gains rather transitory,” say Angel One Wealth analysts.

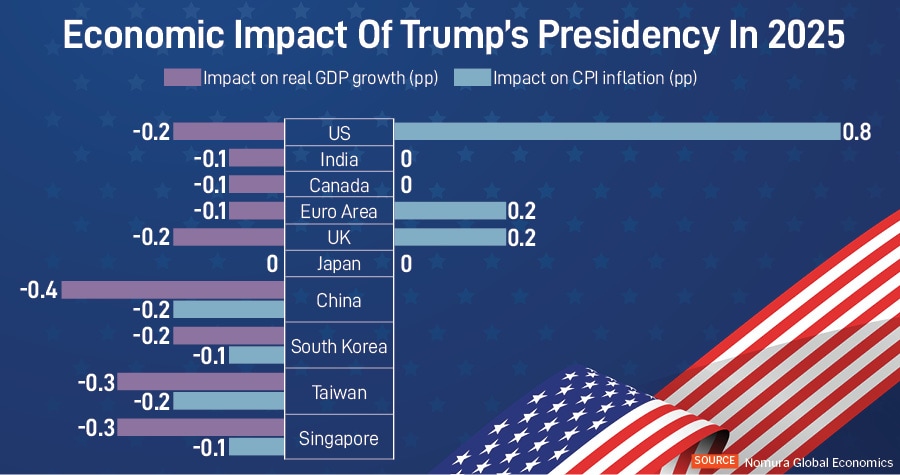

However, economists at Nomura feel that India is a large, domestic demand-driven economy, so the economic fallout of weaker US economic growth should be limited. However, they add that higher tariffs in the US should be stagflationary for the US economy, adding more to inflationary pressures by the second half of 2025, but also weighing on personal consumption and business investment.

As a result, they now expect the US Federal Reserve to cut interest rates just once in 2025.

As widely expected, the US Fed has slashed its policy rate by 25 basis points on November 7 pulling the fed funds rate down to 4.5-4.75 percent. Fed chair Jerome Powell cited recent upward revisions to GDP accounting, still-strong consumption, and a solid labour market as evidence of growth resilience, while attributing much of the current rate of inflation to lagged pressures like shelter and insurance.

Even as Trump means higher US inflation, risks are skewed towards further disinflation in Asia, due to weaker growth, more economic slack, lower energy and the risk of more Chinese exports being dumped into Asia.

India and its businesses

Trump’s protectionist stance is expected to increase polarisation risks between countries. However, the US also sees India as a counterweight to China on foreign policy; so any frictions on trade and immigration will likely be more than offset by the gains accruing to India from the ongoing supply chain shifts, say Sonal Varma and Aurodeep Nandi, economists, Nomura. They add that India and the US share deep economic and strategic interests that are unlikely to be compromised.

Trump’s policy and tariff stance are likely to impact those sectors which are mostly export driven such as IT, pharma and auto.

In his previous stint, Trump tried to curb the H-1B visa programme. His policies led to increased H-1B rejection rates, higher H-1B/L-1 visa processing charges and wage inflation for H-1B resources. Analysts fear that a similar policy stance can’t be ruled out in a second term.

However, Balasubramaniam explains that India IT services players are more insulated now from such anti-immigration policies than they were in 2016. All players have ramped up local hiring in the US. A majority of their US employees are now not dependent on visa (local/green card holders). “The impact of such policies on players’ ability to deliver service or impact on margins due to cost inflation etc. could therefore be limited,” he adds.

Similarly, promotion of local manufacturing is on Trump’s agenda but so is lowering the cost of drugs. That may also impact pharma companies and drug companies in India.

Analysts at Angel One Wealth are optimistic that IT and pharma may benefit from US growth being stronger. “IT could also see a services uptick possibly from global capability centers (GCCs) in India whereas pharma could benefit from more demand for generics under the government programs,” analysts, Angel One Wealth, say.

For Indian auto and ancillaries companies a Trump win and increased tariff on China imports would mean China+1 de-risking can accelerate and may benefit Indian auto ancillary companies in terms of higher exports. However, protectionist policies by Trump might require Indian companies to invest in the US to localise supplies, which were otherwise exported from India.