Canada’s stock market has been on a tear lately.

Since just before the United States election in November, the

index has outperformed both the S&P 500 and the EAFE (Europe, Australasia, and the Far East), according to BMO Capital Markets, and hit a record high this month.

So is this a good omen for the Canadian economy?

BMO senior economist Robert Kavcic looked at the reasons behind the rally in a recent note entitled “

Is the TSX Glitter Economic Gold?

”

Tariff trouble?

Investors don’t like uncertainty and the turmoil thrown up by U.S. President

trade war has been huge. The first thing to remember, though, is markets are always looking at least three to six months ahead. Kavcic said the worst-case scenario for tariffs was arguably priced in months ago and since then Canada’s exemptions under the

Canada-United-States-Mexico Agreement

and a relative pass on Liberation Day has signalled that the tariff bark could be worse than its bite.

The

on the country has been narrow, he said.

face hefty 50 per cent duties, and some auto parts have been penalized, but these industries represent only about 1 per cent of the TSX index.

Get ’em while they’re cheap

Before the trade war broke out, the TSX’s forward earnings multiple was around 15x, compared with above 22x for the S&P 500, “a wide gap from a historical perspective,” said Kavcic.

Bank of Canada beats the crowd

Canada’s central bank cut earlier and deeper than most other advanced economies, leaving its policy rate at a much more neutral level than the Federal Reserve’s.

“The 225 bps of easing in the past year could be taking the brakes off the economy (with a six-to-12-month lag) just when it needs some help, and the TSX could be reflecting that,” he said.

What our market is made of

Over the past 25 years, the correlation between TSX performance and economic growth has been positive, but not as strong as in the United States, where the S&P 500 proves a better bellwether, said Kavcic.

This comes down to composition. The TSX is dominated by financials and energy/materials. While the former picks up on economic conditions, the latter has less sway in the economy than it used to, he said.

Case in point are gold stocks which were five of the top 10 contributors to the TSX’s increase this year, and account for about a third of the gain year to date.

The big guns of the economy, industrials, consumer spending and real estate represent only 12 per cent, 7 per cent and 2 per cent of the index, respectively.

“The TSX is notoriously not a perfect reflection of the underlying Canadian economy given its composition,” said Kavcic.

The bottom line

While the resilience of the Canada’s equity market in this tumultuous time is impressive, Kavcic said BMO would be cautious in passing that strength into the economic outlook.

However, “if the market is indeed discounting a manageable outcome — we’ll take it.”

Sign up here to get Posthaste delivered straight to your inbox.

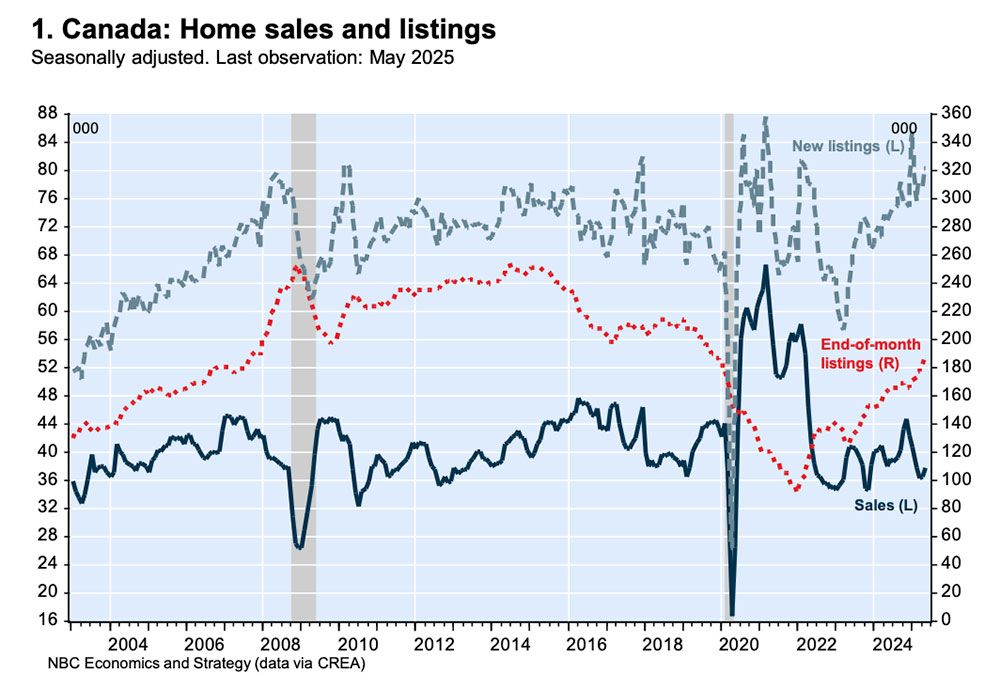

Confidence appears to be slipping back into Canada’s housing market as data Monday showed

from the month before for the first time in more than six months.

“While one good month of home sales doesn’t make a trend, there may be signs of cautious optimism for the resale market for those buyers who remain little affected by the ongoing trade war,” said Kari Norman, an economist with Desjardins Group.

“The combination of lower prices, more inventory and less economic uncertainty may continue to entice more homebuyers back into the market this summer.”

New listings increased by over 3 per cent, but the number of months of inventory edged back for the first time in six months from 5.0 in April to 4.9 in May.

- G7 summit in Kananaskis, Alta. continues

- Today’s Data: Canada international securities transactions, United States retail sales, industrial production and NAHB Housing Market Index

- Trump said he still favours tariffs against Canada as negotiators sit down at G7

- The bond market’s long slump: What it means for investors

- Canada’s home sales rise for the first time in more than six months

The U.S. bond market is in uncharted territory. The drawdown over 58 consecutive months is by far the longest such stretch in recorded history during which the market has endured a peak-to-trough decline of -17.2 per cent, a staggering figure for an asset class traditionally viewed as a safe haven, writes investing pro Martin Pelletier.

It’s a stark reminder for investors that even the most stable-seeming assets are not immune to structural shifts. The message is clear: The old rules may no longer apply, and adaptation is not optional, it’s essential.

Send us your summer job search stories

Last week, we published a feature on the

as student unemployment reaches crisis levels. We want to hear directly from Canadians aged 15-24 about their summer job search.

Send us your story, in 50-100 words, and we’ll publish the best submissions in an upcoming edition of the Financial Post.

You can submit your story by email to

under the subject heading “Summer job stories.” Please include your name, your age, the city and province where you reside, and a phone number to reach you.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here