It’s small wonder that Americans and Canadians are anxiously watching the turbulence U.S. President

trade policies are inflicting on stock markets.

They have a lot riding on them.

According to a

recent report from National Bank of Canada

, corporate equities, both directly and indirectly held, now account for almost 44 per cent of total financial assets for U.S. households — a record high.

“Seemingly taking a cue from their American cousins, Canadian households now possess unprecedented equity exposure too,” said the National Bank economists.

The market value of equity and investment fund shares hit $5.16 trillion at the end of 2024, representing 47 per cent of Canada’s total household financial assets.

“Clearly then, a serious/sustained loss of traction in equities could handicap a Canadian household sector increasingly worried about job prospects and still contending with cost-of-living pressures,” they said.

After

on countries around the world April 2, the S&P 500 shed 15 per cent on the year, but then began rallying days later when the president granted a 90-day delay on many of the duties.

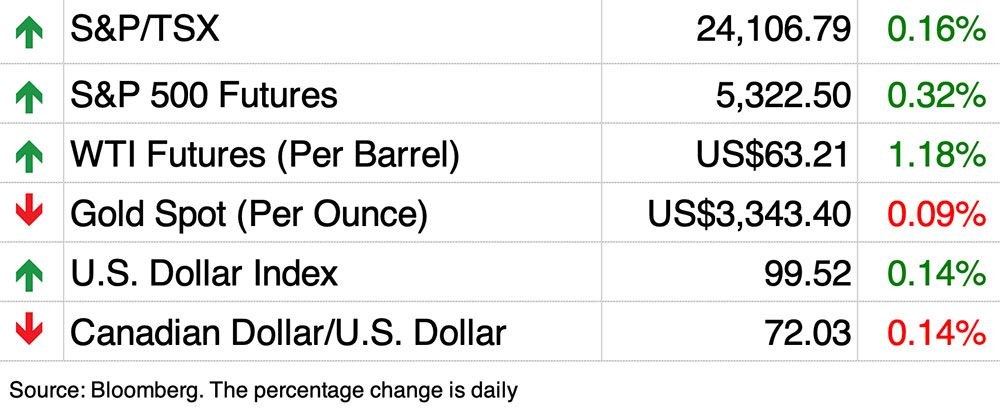

Still, the market continues to swing with every twitch on the trade front, rivalling the turbulence in the depths of the pandemic. Yesterday the S&P 500 closed down 2.2 per cent, but futures are up this morning.

One saving grace to stock losses might have been that Canadians tend to put more of their wealth in

than Americans, but now thanks to the trade war, that too has soured.

Concerns about the potential economic hit from U.S. tariffs have “clearly unsettled buyers” this year, causing many to put their search for a home on pause,

, assistant chief economist at

.

are down 12 per cent since the beginning of the year, dropping 4.8 per cent between February and March. The national composite MLS Home Price Index fell for a third consecutive time in March, and is now down 2.1 per cent from a year ago.

The hardest hit provinces, Ontario and British Columbia, are also the ones where non-financial assets, mostly real estate, account for the larger share of household wealth.

“Weakening labour markets and tariffs threatening to strike southern Ontario’s economy hard has significantly soured market sentiment,” said Hogue.

Home sales have plummeted 21 per cent in Ontario in the past two months and 17 per cent in British Columbia. The sharpest drop is in Toronto where sales were down 27 per cent.

Prices are also dropped in nearly all markets in the two provinces, with declines accelerating in March.

“For more housing-dependent provinces like Ontario and British Columbia, the recent cooling in housing activity is disconcerting,” said National Bank economists Warren Lovely and Daren King.

If the job market softens in these regions, which National says is likely, heavily indebted households are in for a struggle.

“For Canadian households, it seems there are currently few places to hide,” said Lovely and King.

“Little wonder consumers are anxious and governments feel obliged to step up supports for vulnerable regional economies.”

Sign up here to get Posthaste delivered straight to your inbox.

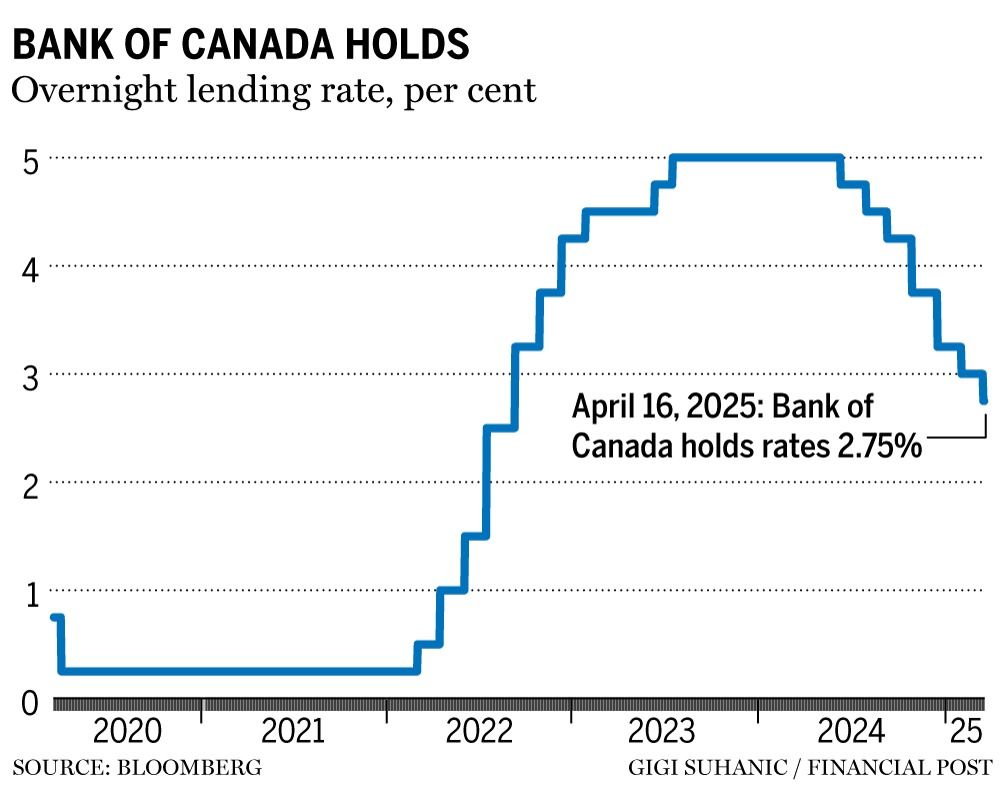

The

broke its streak of seven consecutive cuts on Wednesday when it held its interest rate at 2.75 per cent.

The central bank said it decided to proceed cautiously as events in Donald Trump’s trade war continue to unfold.

Governor Tiff Macklem said during a press conference after the decision that governing council considered cutting by a quarter percentage point, but it ultimately reached a clear consensus for a hold.

“The path of U.S. trade policy remains highly unpredictable,” said Macklem. “There is also considerable uncertainty about the impacts of a trade war on our economy.”

- Today’s Data: Canada international securities transactions, United States housing starts and building permits

- Earnings: Netflix Inc., American Express Co., Blackstone Inc., Charles Schwab Corp., Marsh & McLennan Cos Inc.

- More Canadians are ‘underwater’ on their vehicles and may have no idea they are

- Trump tariff war could trigger flood of red ink in Canada no matter who wins the federal election

- Here’s what happened when a taxpayer claimed a swimming pool as a medical expense

One of the more popular tax credits for Canadians is the medical expense credit, which offers tax relief for above-average medical or disability-related expenses.

Not all expenses, however, qualify, even if recommended by a medical practitioner.

Tax expert Jamie Golombek shows how

with a recent case of an Ontario taxpayer who attempted to claim the cost of a swimming pool as a medical expense.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here