When governments fail to restrain spending during periods of relatively strong resource revenues and save for a rainy-day, they can get into trouble when resources revenues decline.

Article content

According to the Smith government’s latest budget, the government will run a projected $5.2-billion deficit in 2025-26 ($1.2 billion, excluding contingencies), with additional deficits over the next two fiscal years — despite fairly strong projected resource revenue (e.g. oil and gas royalties). This means the government is not only missing out on a chance to improve the province’s fiscal foundation, it’s also putting Alberta’s finances in a vulnerable position if revenue weakens in the future.

Advertisement 2

Article content

Revenue looking good

Article content

Recommended Videos

Article content

Let’s look at the numbers. This year, the Alberta government will receive a projected $74.1 billion in revenue — down from last year’s $80.7 billion but still high from a historical perspective. In nominal terms, revenue is up more than 60% from pre-pandemic levels in 2019-20. This rate of revenue growth has been faster than the rate of inflation-plus-population. In fact, revenue is up 15.2% per-Albertan (inflation-adjusted) from pre-pandemic levels.

Relatively high revenue reflects relatively high resource revenue (in historic terms, adjusted for inflation) despite a decline year over year. Resource revenues are expected to be more than $17 billion each of the next three years, which represents between 22% to 23% of all provincial revenue. For context, in 2015-16 when the province’s revenues were badly hit by the mid-decade commodity price shock, resource revenue was as low as 6.5% of government revenue. Despite relatively high resource revenue, the Alberta government is on track for deficits in each of the next three years.

Article content

Advertisement 3

Article content

Why should Albertans care?

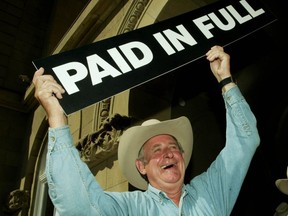

Because when governments fail to restrain spending during periods of relatively strong resource revenues and save for a rainy-day, they can get into trouble when resource revenues decline. For example, in 2015-16 when natural resource revenues fell to under $3 billion, the government ran large and persistent budget deficits, Alberta lost its hard-earned “debt-free” status, and piled up tens of billions of dollars in debt, which continues to burden Alberta taxpayers to this day.

Now, by running deficits during a period of relatively strong revenue, the Smith government is putting the province at risk of another similar period of significant debt accumulation if oil prices decline.

Advertisement 4

Article content

Question of why

All of this raises the question: Why is the Smith government running a deficit despite relatively strong revenue? The answer, as usual, is that once again the government has failed to exercise sufficient spending restraint. For instance, if the Smith government had merely stuck to its spending plan from last year’s budget, rather than increasing spending further in its latest budget, it would have a small surplus this year (excluding budget contingencies).

Alberta’s deficit will mean more taxpayer dollars will be diverted to pay debt interest rather than towards pro-growth policies such as reducing taxes on individuals and businesses. And because the deficit puts the government in a riskier fiscal position, it will be less able to absorb an unexpected future economic downturn.

But it’s not too late. The Smith government can mitigate these risks by changing course. Returning to the spending plan from the 2024 budget would be a good place to start.

Ben Eisen and Tegan Hill are economists at the Fraser Institute.

Article content