Albertans had the highest delinquency rate in Canada

Article content

Credit delinquencies are on the rise as Canadians’ debt climbed to $2.5 trillion in the second quarter, says a report out today.

The latest Market Pulse from Equifax Canada shows credit card holders on average carried over a balance of $4,300, the highest level since 2007.

Outstanding balances on credit cards hit $122 billion, up almost 14 per cent from the same time last year, and the high cost of living and rising unemployment rate are contributing to an increase in missed payments, said Equifax.

Advertisement 2

Article content

One in 23 consumers missed a payment on at least one credit product in the second quarter, up from one in 25 last year. The non-mortgage delinquency rate rose 23.4 per cent to 1.4 per cent, pushing past the peak in 2020 to levels not seen since 2011.

Albertans had the highest delinquency rate in Canada at 2.18 per cent, said another report out today from TransUnion Canada.

This province also saw the highest rise in delinquency, followed by Ontario.

Article content

Auto loans are of particular concern. Auto loan delinquency rates for non-bank lenders hit a historic high and bank auto loan delinquencies are the highest since the pandemic, said Equifax.

“We are seeing many missed payments emerging from consumers who opened new auto loans during 2022, when car prices were particularly high,” said Rebecca Oakes, vice president of advanced analytics at Equifax Canada.

“As car prices start to fall, consumers may be finding themselves in a situation where they are carrying high loan amounts with less equity in the vehicle. We may continue to see increased risk of loan defaults in these cases.”

Article content

Advertisement 3

Article content

The report also highlights the growing strain on younger generations. Missed payment rates for consumers aged 26 to 35 rose to 1.99 per cent, with the delinquency rate on auto loans and lines of credit particularly high.

The economic pressures on young people can also been seen in the changing face of Canadian households.

Equifax says almost one in three Canadian households, 29 per cent, have adult children living with their parents, up from 26.7 per cent a decade ago. In Ontario, the share is 32.8 per cent.

“The economic conditions we’re seeing today may be leading many young people to stay at home longer,” added Oakes. “With fewer job opportunities, soaring rent prices, high housing prices, and the high cost of living, young Canadians are increasingly relying on the support of their parents and grandparents.”

Sign up here to get Posthaste delivered straight to your inbox.

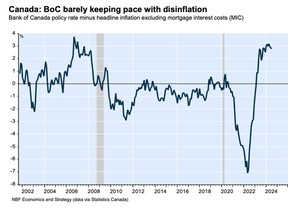

Can the Bank of Canada keep up with cooling inflation?

The consumer price index hit a 40-month low of 2.5 per cent in July, but excluding mortgage interest costs, inflation was just 1.8 per cent, said National Bank of Canada economists Stéfane Marion and Alexandra Ducharme.

Advertisement 4

Article content

Their chart shows that despite two interest rate cuts the bank’s real policy rate “remains one of the most restrictive in a generation.”

“With the BoC barely keeping pace with disinflation, we expect more collateral damage to the economy and labour markets in the coming months,” they said.

- Today’s Data: United States Conference Board consumer confidence, S&P CoreLogic home price index

- Earnings: Bank of Montreal, Bank of Nova Scotia

Recommended from Editorial

Emotional intelligence used to be an overlooked aspect of investing, but portfolio manager John De Goey says some suggest it’s more important than IQ as a determinant of success not only in life, but when investing. Find out more

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line with your contact info and the gist of your problem and we’ll try to find some experts to help you out, while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers, led by Julie Cazzin, can give it a shot.

Advertisement 5

Article content

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Today’s Posthaste was written by Pamela Heaven, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content